Note on The Accounting Cycle by Legum

The Accounting Cycle

Introduction:

This note will discuss the meaning of the accounting cycle and the processes of the accounting cycle. This note will discuss the meaning of the accounting cycle and the processes of the accounting cycle. This note will cover key steps in the accounting cycle, particularly identifying transactions, recording them in books of prime entry, posting them to ledgers, preparing a trial balance, and preparing financial statements.

Meaning of Accounting Cycle:

The Course Manual for Legal Accountancy defines the accounting cycle as follows.

The process of preparing the financial documents, recording the transactions in the ledgers and presenting them in financial statements.

The accounting cycle thus consists of a series of steps that ensure that financial information is accurately and consistently reported. These steps are now discussed.

Steps in the Accounting Cycle:

1. Identifying Transactions:

Businesses engage in numerous financial transactions throughout their operations. For instance, a retail business might acquire a store, purchase goods from suppliers, or make sales to customers, all of which are transactions.

The first step in the accounting cycle is to identify these transactions. To do so, one needs to examine source documents like invoices, receipts, cheques, vouchers, among others, all of which are records that provide evidence of the transactions.

2. Recording Transactions into Books of Prime Entry:

A. Meaning of Books of Prime Entry:

The identified transactions in step one are then recorded into books known as the books of prime entry, journals, books of original entry, books of first entry, day books, or subsidiary books. In the course manual, these books are described as

Those books in which transactions are entered for the first time after source documents are produced.

B. Types of Books of Prime Entry

There are six books of prime entry. These are discussed below.

- Cash book: This book records all cash receipts and payments, including bank transactions. For example, once there is a cash purchase, a cash sale, or anything involving cash, an entry is made into the cash book. It is prepared using receipts, bank statements, and payment vouchers.

- Purchases journal or purchases day book: These are used to record credit purchases. Here, the focus is on credit purchases and not cash purchases because on cash purchases, payment is made to the supplier and recorded in the cash book. It is prepared using purchase invoices.

- Sales journal or sales day book: These are used to record credit sales. Here, the focus is on credit sales and not cash sales because on cash sales, cash is received and recorded in the cash book. It is prepared using sales invoices.

- Returns inwards journal: Records goods returned by customers due to defects, damage, or some other reason. Its source documents are the credit notes issued.

- Returns outwards journal: Records all goods returned to suppliers due to defects, wrong orders, or some other reason. Its source documents are credit notes received.

- General journal or journal proper: These are used to record all non-routine transactions that do not fit into the other books of original entry discussed above. For instance, it records the acquisition of fixed assets on credit, writing off bad debts, among others.

C. Recording into the Books of Prime Entry

In making journal entries or recording into the books of prime entry, it is essential to take note of the following:

i. The entries in the journals are entered chronologically. Thus, a credit purchase on 1 st January, 2024 will be recorded first before a credit purchase on 2 nd January, 2024.

ii. Each entry states the date of the transaction, the affected accounts, and the amounts.

iii. Transactions in books of prime entry are recorded in a summarized form and does not often use the double-entry method. In practice, one simply has a book (preferably a foolscap) with the following columns:

a. Date: The date of the transaction.

b. Particulars: This often contains the name of the customer or supplier and details of the goods bought, sold, or returned.

c. Ledger Folio (abbreviated as L/F): This is usually the page number of a ledger account to which the transaction is posted.

d. Details: This is for recording trade discounts.

e. Amount: This contains the net amount.

D. Sample Book of Prime Entry (Purchases Journal):

Below is a sample of a purchases daybook/journal/book of prime entry from the Ministry of Education [1]:

3. Posting Entries from the Books of Prime Entry to Ledgers:

The transactions recorded in the books of prime entry (such as the sales journal, purchase journal, and cash book) are transferred, or posted, to ledger accounts in the general ledger, also known as the principal books of accounts or books of final entry.

The general ledger is described by Horngren et al. in Introduction to Financial Accounting, 11 th ed., as follows:

You can think of the general ledger as a book with one page for each account. When you hear about “keeping the books” or “auditing the books,” the word books refers to the general ledger, even if it is an electronic file. [2]

Each account in the general ledger is known as a ledger account (So the general ledger consists of individual ledger accounts). These ledger accounts, also known as T-accounts, will contain the transactions posted from the journals. By “posted,” we refer to the process of transferring financial information from the journal entries/daybooks to the ledger accounts contained in the General Ledger.

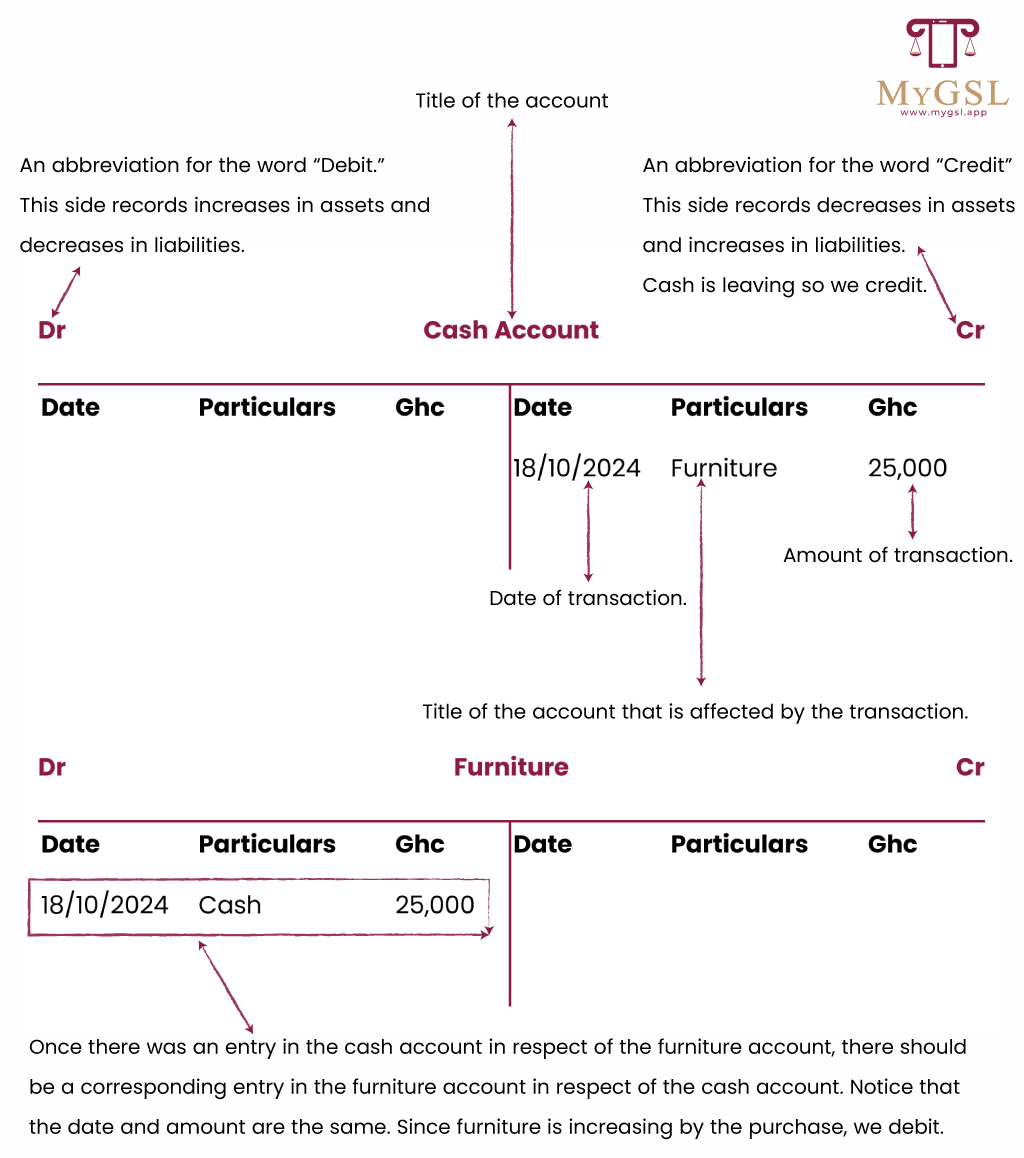

In posting the transactions, the double-entry method of bookkeeping is used. This method, discussed extensively in subsequent notes, is based on the fundamental principle that every financial transaction affects at least two accounts—one account is debited, and the other is credited. When an asset account, like the cash account, is credited, it means its value is reducing. Conversely, when an asset account is debited, it means its value is increasing. In a cash purchase of furniture, which is an asset, the value of cash will reduce (because the payment for the furniture was by cash) and the value of the furniture will increase (because more furniture was acquired by cash). Under the double entry method of bookkeeping, the cash account will be credited and the furniture account will be debited. This credit and debit in the cash account and furniture account respectively represent a double entry of the same transaction—the purchase of furniture using cash.

Below is an illustration of making entries in the cash book and a furniture account in accordance with the double-entry bookkeeping method described above:

4. Trial Balance:

At some point, usually at the end of the accounting period, which may be monthly, quarterly, or yearly, a trial balance is prepared from the entries in the ledgers. Horngren et al. described the trial balance as

A list of all the accounts in the general ledger together with their balances. This list aids in verifying clerical accuracy and in preparing financial statements.

According to the Ministry of Education [1], the trial balance is:

A financial statement showing the closing balances of all accounts in the general ledger of a business at a point in time.

The trial balance has got two columns; a debit column and a credit column. The debit column shows all the debit balances, and the credit shows all credit balances in the different ledger accounts. The total of the two columns should be equal so the total of the debit column should be the same as the total of the credit column. [emphasis is ours]

In the course manual, it is similarly stated that:

The trial balance is prepared to assemble all debit and credit balances in the ledger to test the arithmetical accuracy of the entries made in the ledgers. As a matter of fact, if all the entries in the ledgers are correctly made, the aggregates of the debit and credit balances will be equal.

Thus, simply put, the trial balance is a statement prepared to assess whether all debit entries have corresponding credit entries. It can therefore be established that the trial balance:

- Is a means of checking to see whether the accounting entries made in the ledgers were correctly done in compliance with the double entry system.

- Provides a basis for ensuring that all the original entries have been recorded correctly.

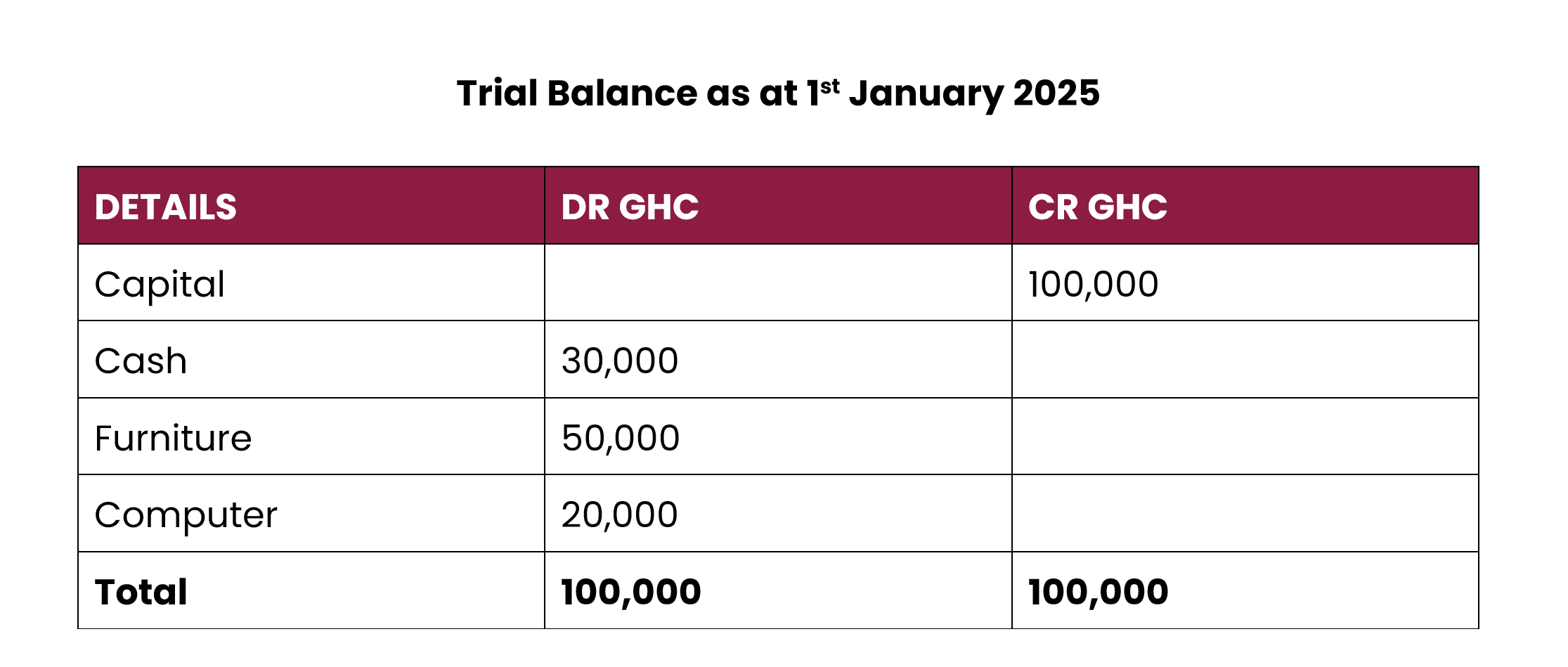

The trial balance will be discussed extensively in subsequent notes. For now, it is sufficient to understand that the entries that are made in the trial balance are the balances of each ledger account. For instance, let us say Ghc 100,000 was received in the cash account from the capital account, and Ghc 50,000 was used to buy furniture, and Ghc 20,000 was used to buy a computer. At the end of the day, the cash balance would be Ghc 100,000 – Ghc 50,000 – Ghc 20,000 = Ghc 30,000. The ledger accounts for cash, furniture, and computer will look as follows (note that capital has not been included, but it should be if you are solving a question):

The closing balances of each ledger account, described as balance b/d, which is an abbreviation for balance brought down, and as shown in the illustration above, are extracted and entered in the corresponding section of the trial balance as follows:

From the above, cash had a closing balance of Ghc 30,000, which was on the debit side, so we record this amount in the debit column of the trial balance. Furniture had a closing balance of Ghc 50,000, which was also on the debit side, so we record this too in the debit column of the trial balance. Finally, the computer has a closing balance of Ghc 20,000, which was also on the debit side, so we record this amount too in the debit column of the trial balance. Because capital contributed Ghc 100,000 to cash, it was credited, and a balance c/d of Ghc 100,000 was entered at the debit side. This amount would be the balance b/d at the credit side. This explains why in the trial balance above, the amount of Ghc 100,000 appears in the credit column.

What is essential from the trial balance above is that the totals of the debit and credit columns are equal. This is prima facie evidence that the entries in the various ledgers were correct and in accordance with the double-entry method of bookkeeping.

5. Worksheet:

In the standard accounting cycle, the fifth stage of the cycle is the preparation of a worksheet. This will not be discussed in this course.

6. Adjustments:

In the standard accounting cycle, the sixth stage of the cycle is making adjustments to the entries, particularly if there are errors. This too will not be discussed in this note.

7. Preparation of Financial Statements:

The trial balance provides information for preparing the income statement and the statement of financial position.

The income statement is a report of all revenues and expenses of a business. It shows whether the business is making profits or incurring losses at the end of the accounting period.

The statement of financial position, also known as the balance sheet, presents an entity’s assets, liabilities, and equity at a given point in time.

8. Closing Accounts:

After preparing these statements, the accounting cycle concludes with the closing of accounts. This will be discussed further in subsequent notes